Math Whiz Wins Wall Street

After realizing that a job at a structural engineering firm would not be the right fit for him, Ali Hirsa could have switched to electrical engineering or become a doctor. But two professors changed his life course, helping the man who would become a Wall Street pro discover the possibilities math offered a dedicated worker with a creative and insightful mind.

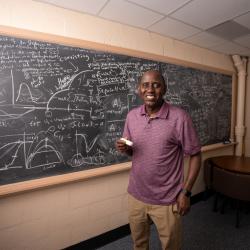

Today, Ali Hirsa, M.A. ’97, Ph.D. ’98, applied mathematics, is managing partner at Sauma Capital and an adjunct professor at Columbia University. He has helped investment firms protect their assets, patented methods for post-trade allocations, and written books and journal articles that guide future financiers.

Hirsa emigrated from Iran at the age of 25, coming to the University of Maryland largely because he had missed a language test required by another school. He fell in love with the university and his classmates quickly, taking as many math courses as possible, even though his first Maryland degree would be in civil engineering (M.S. ’93). Though he had hoped to launch his own construction business, Hirsa realized this career did not suit his “high-energy” persona. He decided instead to work on a master’s degree in applied mathematics because it would give him options in engineering, biology or the rapidly changing field of computer science.

He still remembers vividly how nervous he was when Mathematics Professor Jeffery Cooper sent him to meet with Smith School of Business Professor of Finance Dilip Madan, M.A. ’71, Ph.D. ’75, mathematics; Ph.D. ’72, economics.

“I was literally in love with mathematics,” recalls Hirsa. “But I got so scared at that first meeting. I didn’t really know anything about the mathematics of finance field.”

Though intimidated by Madan’s line of questioning, Hirsa made up his mind: he would prove himself a top-notch candidate. Once in the graduate program, Hirsa gave selflessly as a graduate assistant, spearheading study groups outside of his required commitment. He worked on two dissertations (one with Madan and a second with Computer Science Professor Howard Elman), developing algorithms for complex mathematical models to help explain what drives sudden jumps in commodity and stock prices.

“It was a great collaboration,” says Madan. “We would discuss problem formulation at an abstract level, and a few weeks later Ali would present fully worked-out solutions, complete with graphs, comparisons and convergence speeds. It was clear he would be going places, given the level of his focus, determination and sheer energy.”

Among the places Hirsa has gone? Banc of America Securities, Morgan Stanley and Caspian Capital Management. As a frequent conference speaker, he still runs into Madan often. The two will sit together after a long day of presentations and dig into the details of one another’s latest mathematical problems.

“He shows me how much I still have to learn,” says Hirsa, who is also a member of University of Maryland College Park Foundation’s board of trustees. “I can show him a three-page proof and he will reduce it to a three-line solution.”

Hirsa credits Madan and Elman with helping him break into Wall Street, even though he didn’t have the Ivy League degree some employers thought of as essential at the time.

“I still use what I learned from them,” Hirsa says. “Dilip taught me how to use mathematics in financial applications, and Howard taught me how to build scalable and efficient algorithms.”

Hirsa cut his teeth as a quantitative analyst, or “quant,” determining equations and creating pricing engines and options for trading and risk management. By 2004, he moved to the buy side as a quant trader. The self-proclaimed “math geek” had to find his footing again.

“At Morgan Stanley, I was helping the firm not lose money; I had not developed strategies for making money,” Hirsa says. “I learned you have to be able to sleep on a big bet. You could make or lose tons over a short period and lose your job over it. It is nerve wracking, but exciting.”

Hirsa’s approach is to gather knowledge from as many sources as possible, including statisticians, linguists and even philosophers.

“There are so many factors at play: politics, a housing crisis, international factors,” Hirsa says. “A day later, the best equations won’t be right.”

Even with his financial and academic success, the husband, and father of a six-year-old son, remains humble. He loves sharing what he has learned with students. Hoarse after a three-hour lecture, he brags about master’s students with the potential to become top-notch researchers. He hopes to offer them the same supportive, yet challenging, learning environment his Maryland professors did years ago. Madan says he is not surprised Hirsa would continue teaching after so much investment success, but he still admires his friend’s commitment and focus.

“Many people wander through their lives, taking charge of some things for some time, but then there are slippages and leaks,” says Madan. “Not with Ali.”

Writer: Kimberly Marsalas

This article was published in the Summer 2015 issue of Odyssey magazine. To read other stories from that issue, please visit go.umd.edu/odyssey.